South Africa’s road accident stats are so much more than numbers on a page. They’re reminders of the everyday risks we all face when we sit behind the wheel. Our roads are dangerous enough. Now add some students coming home from a party or a few quick glances at some WhatsApps in peak-hour traffic, and you’ve got a recipe for disaster and devastation. Let’s unpack our road accident stats and how to stay safe on Mzansi’s roads.

While you can’t always predict what other drivers will do, you can ensure you’re protected with comprehensive car insurance. Chat to us or get a quote today!

The Reality of Road Deaths in South Africa

Every year, on average, 14,000 people lose their lives on South African roads.

And the scary truth is that it’s not the roads or the cars that are the problem; it’s how we drive. “South Africa has some of the worst road traffic injury statistics in the world,” says Arrive Alive. “Each year, millions of people are killed or injured on our roads.”

Causes of Car Accidents in South Africa

Drunk Driving Accident Stats

Alcohol remains the biggest villain on our roads, linked to approximately 65% of fatal crashes. Even just one drink slows your reactions and clouds your judgment. The idea of “just one” isn’t harmless; it’s dangerous.

Texting While Driving Stats and Impact

You wouldn’t close your eyes for 10 seconds while driving. Yet that’s precisely what happens when you look at your phone while going 120 on the N2… You’re effectively driving blind for let’s say 100 metres. No meme or group chat is worth the crash caused by texting while you’re driving.

Fatigue Driving Stats: The Silent Risk

Studies show fatigue can be as impairing as alcohol. Long stretches of road, late nights, or certain medications can cause “microsleeps” where you lose focus for just a few seconds… and that’s all it takes.

What is Microsleep?

It’s when your brain flips rapidly between being asleep and being awake. The episodes last only a few seconds, and often, you aren’t aware of them. These brief and involuntary periods of sleep can lead to a loss of control and potentially fatal accidents,

Understanding Car Accident Fatalities

Behind every statistic is a person with a name, family, partner, or friend, forever changed. Cause of death statistics point mainly to drunk driving, distraction, and fatigue, but the truth is that these high numbers are preventable.

And it’s not only drivers who suffer. Passengers, especially children, are at risk too. Car seat death statistics show just how vital proper restraints are. A poorly fitted seatbelt or skipping a child safety seat can mean the difference between life and death in a crash.

Data also reveals that approximately 35-40% of road deaths in SA are pedestrian deaths. That’s right. Innocent pedestrians are a part of these scary road accident stats, too.

How to Stay Safe on South African Roads

- Skip the drink. Alcohol and driving do not mix.

- Take breaks. On long trips, stop every two hours to stretch, snack, and reset your focus.

- Ditch distractions. Put your phone in the boot if you can’t resist the ping. We’re being serious!

- Check your meds. Some prescriptions can slow reaction times, so read the fine print to ensure you are fit to drive.

It’s Not Just a Stat. It’s a Life

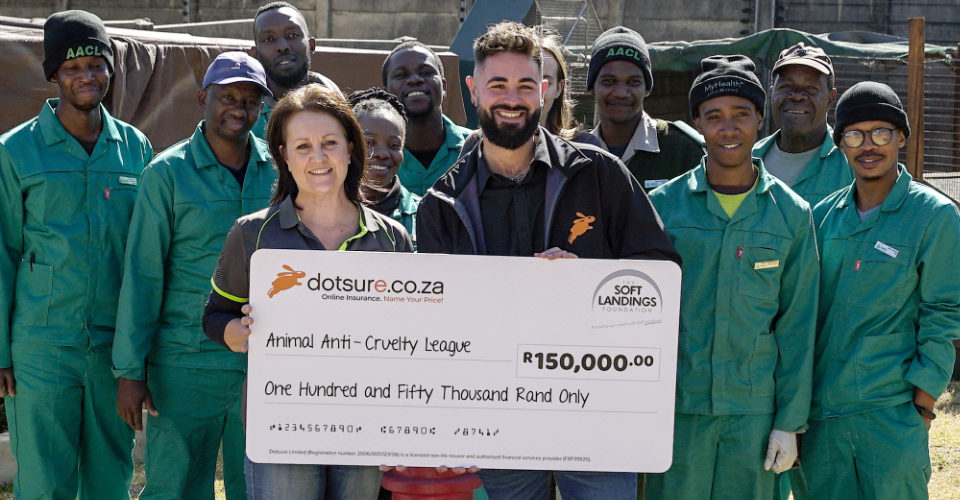

Yes, the road accident stats in SA are scary, but the good news is that we can change them. Every time we choose to drive sober, rest well, and keep our eyes on the road, we’re lowering those numbers. Insurance can help too.

With dotsure.co.za car insurance and the Smart Driver Programme, we’re encouraging a generation of smarter drivers who make smarter moves behind the wheel and are rewarded! You want to know more? Contact us and ask our friendly consultants about game-changing cover.